About Short-Term Loans

Loan available for 7 days, 15 days, 30 days and 62 days.

Loan limits: Minimum: Ksh 5,000 Maximum: Ksh 200,000

No Processing Charges or Hidden Costs!

Competitive Interest Rates of 4.75%, 6.75%, 8.75% & 18.75% for Loan Tenures of 7, 15, 30 and 62 days respectively

No Questions asked!

Flexible Repayment of Loans through our full or partial repayment module.

No Security Required!

Three Top ups available within your approved limit across all loan tenures!

100% Interest Refund on every 7th loan provided the previous six loans are paid on or before the due date.

Referral Bonus available for referring Colleagues/Friends.

LITTLE PESA SHORT-TERM LOANS

How it works

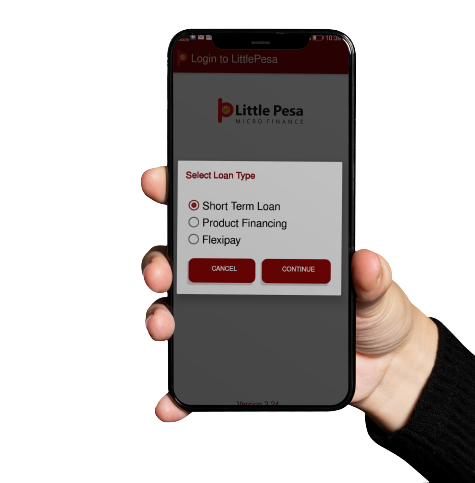

Sign in

- Input your PIN.

- Choose Short Term Loans option.

- Click on ‘Apply’ Button.

- Request loan

– Your loan limit is displayed.

Loan Amount & Duration

- Select Loan Duration and Input Loan Amount.

- Accept Terms & Conditions & Request loan.

- Confirmation Pop up appears.

Loan Disbursement

- Click Apply and your M-PESA account is credited instantly!

Need Help with Short-Term Loans?

Frequently Asked Questions

1. What are the requirements for availing a short-term loan?

Just ID Copy, Pay slip and Safaricom Mobile number. On approval, you will get an SMS from Little Pesa specifying the loan limit approved.

2. How do I Activate the Account?

The account can be activated by entering your ID no. and mobile no. Upon activation, you will receive One Time PIN (OTP) from Little Pesa and once you enter the said OTP, you will be prompted to change the PIN to four digits of your choice.

3. What are the loan periods and the applicable interest rates?

7 days loan – 4.75% , 15 days loan – 6.75%,30 days loan – 8.75% flat and 62 Days – 18.75%.

4. What is the processing fee and any hidden charges?

There is No Processing Fee and No Hidden Charge. Apart from interest, we only charge Ksh 60 per disbursement as M-Pesa charge. The disbursement charge of Ksh 60 remains same for a disbursement up to Ksh 200,000.

5. How is the Interest charged?

The Interest is upfront i.e., deducted from the loan amount. For example, if you apply for a loan of Ksh 10,000 for a period of 30 days, interest of Ksh 875 and disbursement charge of Ksh 60 shall be deducted from the loan amount and you will be disbursed Ksh 9,065. On due date, you will need to pay only Ksh 10,000.

6. What are the loan limits and what is the basis of the limits?

Our loan limits are based on your Net Pay—limit is usually 30% to 50% of your net pay. The maximum loan limit is capped at Ksh 200,000. However, you can avail a minimum loan of Ksh 1,000 within your limit.

7. Can I have multiple loans within my loan limit?

Yes. Three Top Up loans across all loan tenures (7 days, 15 day & 30 days) are available within your limit till the due date of the loan without being required to clear the outstanding balance first.

8. What is the time gap for availing another loan after I have cleared my earlier loan?

The loan balance is updated immediately you repay your loan and within seconds, you become eligible for another loan within your loan limit.

9. How do I repay my loan?

You can repay your loan by tapping Repay Loan Icon on our App’s Home screen or through our USSD by dialing *483*93#. Safaricom M-Pesa screen will appear in our App and USSD for you to enter your M-Pesa PIN and repay the loan. Additionally, you can repay your loan through our Paybill no. 755141 – your mobile no. will be your account no.

10. Can I prepay my loan?

Yes. If you avail a loan for a period of 30 days and repay within 7 days or 15 days, you shall be charged interest rate for the period you have used the loan and excess interest shall be refunded to you on your next loan.

11. Can I repay loan on behalf of another person?

Yes, you can. You need to go to your Safaricom M-Pesa, tap LIPA NA M-PESA and then fill as under: – Paybill no. 755141 Account no. Mobile no. of the person you are paying for Amount Ksh you want to pay

12. What happens if I lose/change my mobile phone?

Your money remains safe as your funds can only be credited to your M-Pesa account which is protected by your M-Pesa PIN. As an additional security measure, our system does not allow accessing our services on another device. Accordingly, you need to contact us for resetting your device in case of change of Mobile Phone.

13. What happens if I am not able to repay my loan by the due date?

If you are not able to repay the loan within the stipulated time, there is a provision for one-time automatic roll over of the outstanding with a nominal extra interest of 2% over the prevailing rate for another tenure.

14. What happens if I am not able to repay the loan even within the rolled over period?

In that case, the loan is considered as a Default and appropriate recovery proceedings will be initiated by the company.