Who We Are

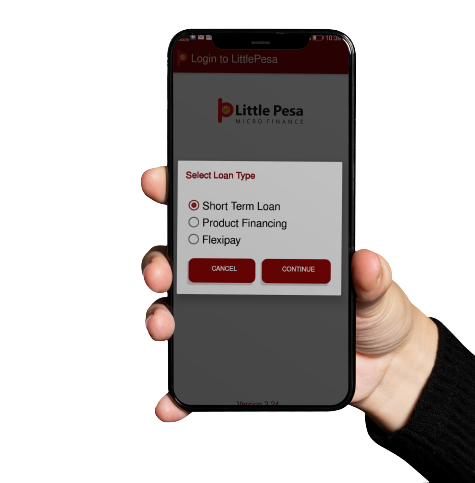

Little Pesa Ltd is a non-deposit-taking Microfinance. It was formed in 2018 after taking necessary NOC from the Central Bank of Kenya. The company started lending in January 2019. Initially, we were extending only Short-Term loan limits to salaried persons. Now, the company has three product offerings:-

Little Pesa Products

Product Financing Loans

Borrowers can buy products from select retail shops up to Ksh 300,000 and the same can be repaid in monthly instalments spread over 3-12 months. The rate of interest is 5% p.m. for 3 months, 4.5% p.m. for 6 months, 4% p.m. for 9 months and 3.5 % p.m. for 12 months.

Short-Term Loans

Borrowers can avail loans for 7 days, 15 days, 30 days & 62 Days up to Ksh 300,000. The rate of interest is 4%,6% , 8% & 18% for 7 days, 15 days, 30 days & 62 days respectively. If a borrower is unable to repay the loan within the stipulated period, the loan is automatically rolled over for another 7 days, 15 days or 30 days as the case may be at 2% over the original rate of interest.

Flexipay Loans

Borrowers can avail higher limits of Ksh 300,000 and the repayment is spread over 3-12 months. Competitive Interest Rates of 6% p.m. for 3 months, 5.5% p.m. for 6 months, 5% p.m. for 9 months and 4.5% p.m. for 12 months

Vision

To be a Microfinance of Choice in Kenya.

Mission

To enable people to satisfy emergency financial requirements and achieve financial stability at most competitive interest rates

Core Values

Integrity

Transparency

Excellence

Meet Our Team

Board of Directors

Rajesh Vadgama

Chairman

Rajesh Vadgama

Chairman

Rakesh Kashyap

Managing Director

Rakesh Kashyap

Managing Director

Sachin Shaha

Director

Sachin Shaha

Director

Hemil Patel

Director

Hemil Patel

Director